What is the Process of Candy Import Customs Clearance?

2022-09-26

What is the Process of Candy Import Customs Clearance?

Importing candy into any country can be a complex process. To ensure your candies arrive smoothly and are ready for sale, understanding the customs clearance process is crucial. Here's an easy-to-follow guide designed specifically for candy importers to help you navigate the import process, from necessary documentation to overcoming common challenges.

Customs clearance for candy imports involves preparing the right documents, calculating duties, undergoing inspections, and finally, clearing customs. It’s a multifaceted process that, when understood and executed properly, ensures your products move smoothly through border controls.

Continuing to read will equip you with essential knowledge to streamline your import operations and avoid common setbacks that can sour your business.

Candy Imports and Why Customs Clearance Matters

When importing candy, customs clearance is an essential step that verifies your products meet the legal requirements of the destination country. This process ensures:

· The safety and quality of the candy.

· Compliance with import regulations.

· Proper documentation to avoid penalties and delays.

Without proper customs clearance, you risk fines, confiscation of goods, and significant delays that could impact your business operations.

What documents are essential for candy import customs clearance?

Before you can even think about your candy crossing borders, you need to have your paperwork in perfect order. Here's what you typically need:

Bill of Lading (BOL): This legal document issued by a carrier details the type, quantity, and destination of the goods being carried.

Commercial Invoice: It provides customs with the value of the goods, essential for assessing duties and taxes.

Certificate of Origin: This certifies the country where the goods were manufactured, affecting duty rates and compliance with trade agreements.

Sanitary Registration: Essential for edible products, proving your candy complies with health standards of the importing country.

Failure to provide any of these documents can result in delays, fines, or even confiscation of your candy shipment.

How are duties and taxes assessed on imported candy?

Importing candy involves various types of customs duties and taxes. Here's what you need to know:

Importing candy involves various types of customs duties and taxes. Here's what you need to know:

· Customs Duties: Based on the candy's classification under the Harmonized System (HS) codes.

· Value-Added Tax (VAT) or Goods and Services Tax (GST): Applied based on the value of the goods.

· Excise Duties: Specific to certain types of candy, such as chocolate or sugar-laden products.

These are typically calculated based on the value of the goods (ad valorem), the weight or quantity of the goods, or a combination of these factors. To estimate these costs before shipping, you can visit simplyduty.com, a helpful resource for candy importers.

What inspections might your candy undergo during customs clearance?

Inspections are a standard part of the import process, especially for food items like candy. Your imports might be subjected to:

· Physical Inspection: Where customs officials visually and physically examine the shipment to verify documents and labels.

· Sanitary Inspection: Conducted to ensure that the candy adheres to the health regulations of the importing country. This might involve laboratory testing to check for contaminants or harmful substances.

※Step-by-Step Guide: A Roadmap Through the Customs Clearance Process

Navigating the customs clearance process can be straightforward if you follow these steps:

Preparation of Documents: Gather all necessary paperwork, including Certificates of Origin, Health Certificates, invoices, and packing lists.

Submission of Documents: Submit the documents to the customs authority either electronically or physically.

Customs Review: The customs officer reviews the documents for compliance.

Payment of Duties and Taxes: Pay any applicable duties and taxes as assessed by customs.

Physical Inspection: If required, customs may physically inspect the shipment to verify the contents and ensure compliance.

Release of Goods: Once all checks are completed and payments made, your candy shipment is cleared for entry.

How to Tackle Common Import Hurdles?

· Documentation Errors: Double-check all documents for accuracy to prevent delays.

· Unforeseen Delays: Work with a reliable customs broker to expedite the process and manage delays.

· Regulatory Changes: Stay informed about changes in import regulations to ensure compliance.

· Product-Specific Regulations: Different countries have specific regulations for food imports. Understanding these can save you time.

How do you effectively clear customs with your candy imports?

Clearing customs smoothly involves more than just having all your documents in order and understanding the inspection process. Here are some tips:

1. Work with experienced brokers and freight forwarders: These professionals understand the intricacies of customs processes and can offer invaluable assistance.

2. Ensure all documentation is complete and accurate: Any discrepancies can lead to delays.

3. Prepare for potential delays: Sometimes, inspections and other processes can take longer than expected. Planning for these contingencies can help you manage your business operations without significant disruptions.

Conclusion

Successfully importing candy requires diligence and an understanding of the customs clearance process. From securing the right documentation to navigating duties, taxes, and potential hurdles, following these steps ensures a smooth process. Remember, compliance is not just a legal requirement but a pathway to building a reputable and successful candy import business.

For more tips and expert guidance on candy imports and customs clearance, feel free to reach out to industry professionals or consult with customs brokers who can provide tailored solutions for your needs.

Suifa news

How is Bubble Gum Made in the Factory?

2023-05-24

How Hard Candy is Made in the Factory?

2024-02-28

Get An Instant Quotation

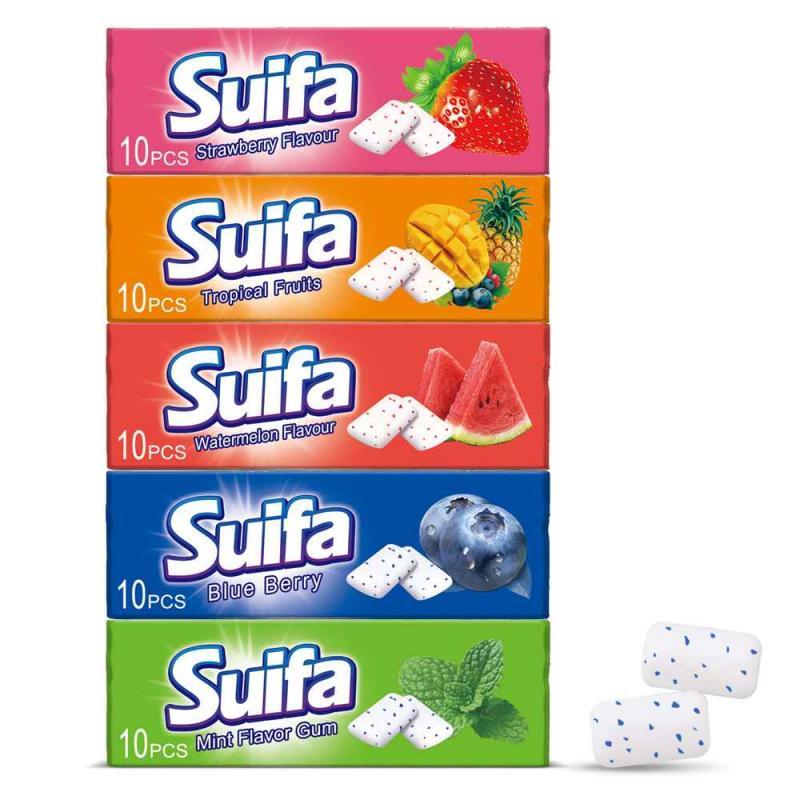

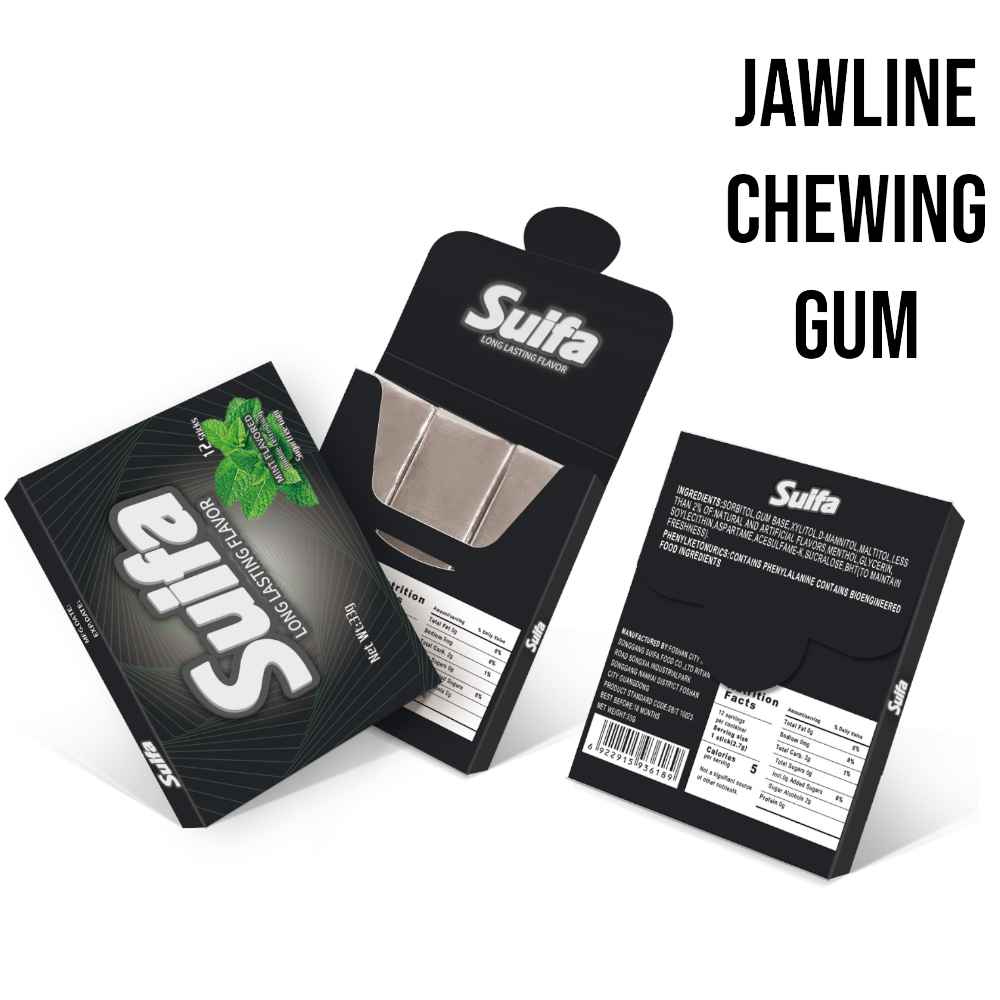

Recommended Products

Bulk Healthy Natural Xylitol Sugar Free Tablet Chewing Gum

Detail

Checking Order

Quality Test Before Delivery

Check Items When Packing

Packaging And Transport

Send Inquiry Now!

Choose Suifa, Boost Your Candy and Gum Project!

Discover excellent gum and candy products at our factory. We create custom solutions for our customers. Join us for exclusive insights, customized products and partnerships. Leave your contact info we'll be back in touch within 12 hours!

Choose Suifa, take your bussiness to the next level!

Contact Us

WELCOME TO SUIFAFOOD YOUR TRUSTED MANUFACTURER OF GUM AND CANDY

Address: No.8 Ritian Road Songxia lndustrial AreaSonggang Nanhai, Foshan, Guangdong, China